Man Robbed of 16 Bitcoin Sues Young Thieves’ Parents

jeudi 26 août 2021 à 00:20In 2018, Andrew Schober was digitally mugged for approximately $1 million worth of bitcoin. After several years of working with investigators, Schober says he’s confident he has located two young men in the United Kingdom responsible for developing a clever piece of digital clipboard-stealing malware that let them siphon his crypto holdings. Schober is now suing each of their parents in a civil case that seeks to extract what their children would not return voluntarily.

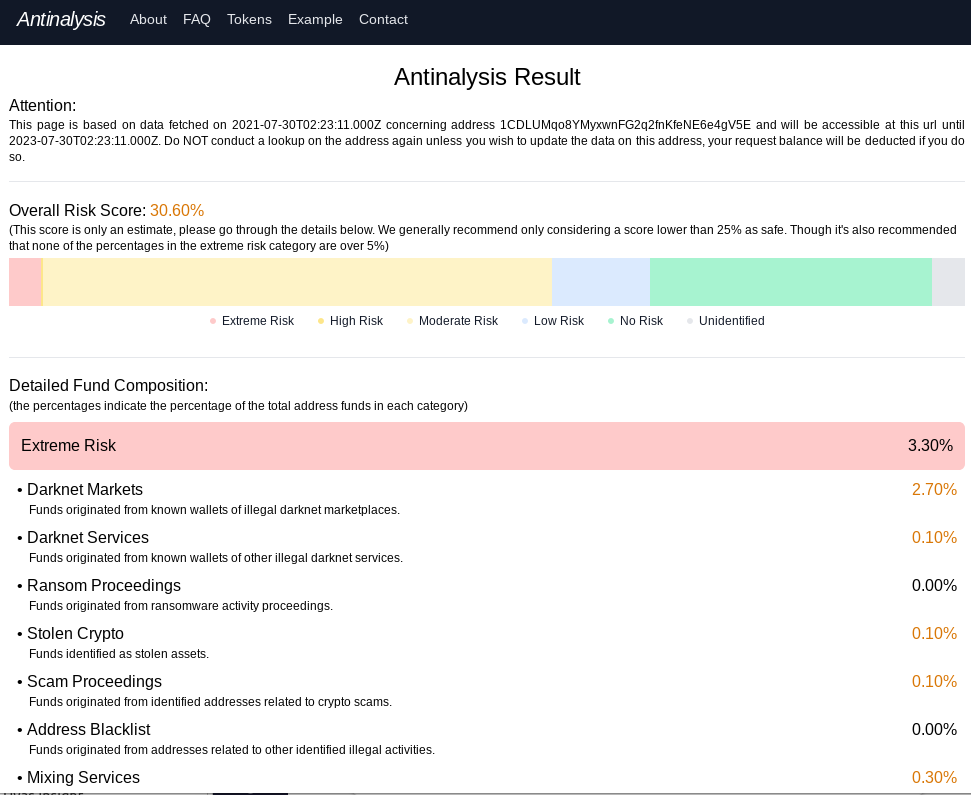

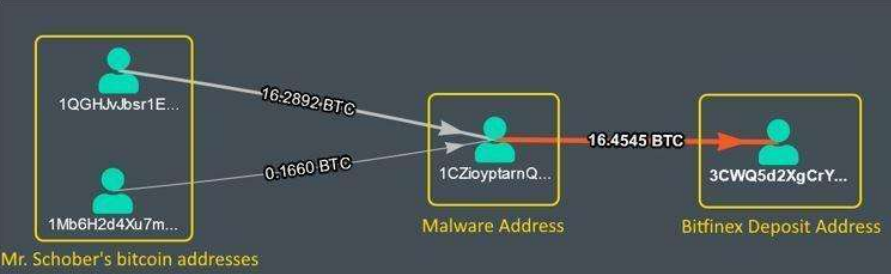

In a lawsuit filed in Colorado, Schober said the sudden disappearance of his funds in January 2018 prompted him to spend more than $10,000 hiring experts in the field of tracing cryptocurrency transactions. After months of sleuthing, his investigators identified the likely culprits: Two young men in Britain who were both minors at the time of the crime.

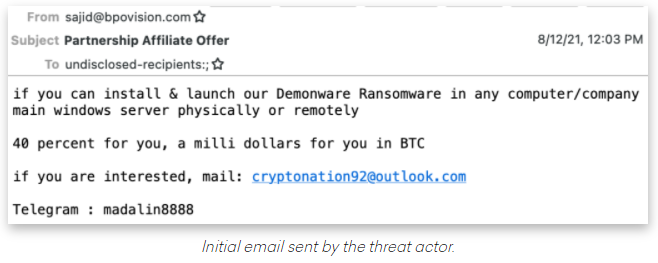

A forensic investigation of Schober’s computer found he’d inadvertently downloaded malicious software after clicking a link posted on Reddit for a purported cryptocurrency wallet application called “Electrum Atom.” Investigators determined that the malware was bundled with the benign program, and was designed to lie in wait for users to copy a cryptocurrency address to their computer’s temporary clipboard.

When Schober went to move approximately 16.4 bitcoins from one account to another — by pasting the lengthy payment address he’d just copied — the malware replaced his bitcoin payment address with a different address controlled by the young men.

Schober’s lawsuit lays out how his investigators traced the stolen funds through cryptocurrency exchanges and on to the two youths in the United Kingdom. In addition, they found one of the defendants — just hours after Schober’s bitcoin was stolen — had posted a message to GitHub asking for help accessing the private key corresponding to the public key of the bitcoin address used by the clipboard-stealing malware.

Investigators found the other defendant had the malware code that was bundled with the Electrum Atom application in his Github code library.

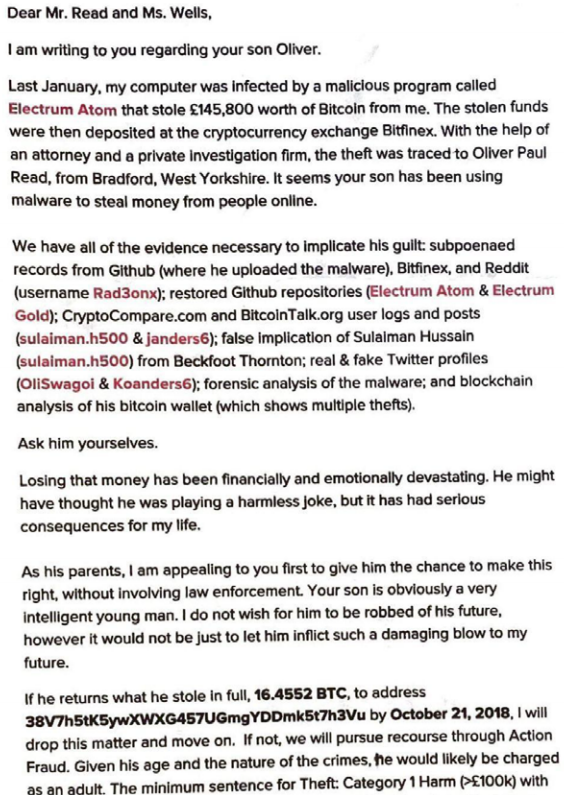

Initially, Schober hoped that the parents of the thieving teens would listen to reason, and simply return the money. So he wrote a letter to the parents of both boys:

“It seems your son has been using malware to steal money from people online,” reads the opening paragraph of the letter Schober emailed to the parents of the boys, both of whom are studying computer science at U.K. universities. “Losing that money has been financially and emotionally devastating. He might have thought he was playing a harmless joke, but it has had serious consequences for my life.”

A portion of the letter than Schober sent to two of the defendants in 2018, after investigators determined their sons were responsible for stealing nearly $1 million in cryptocurrency from Schober.

Met with continued silence from the parents for many months, Schober filed suit against the kids and their parents in a Colorado court. A copy of the May 2021 complaint is here (PDF).

Now they are responding. One of the defendants —Hazel D. Wells — just filed a motion with the court to represent herself and her son in lieu of hiring an attorney. In a filing on Aug. 9, Wells helpfully included the letter in the screenshot above, and volunteered that her son had been questioned by U.K. authorities in connection with the bitcoin theft.

Neither of the defendants’ families are disputing the basic claim that their kids stole from Mr. Schober. Rather, they’re claiming that time has run out on Schober’s legal ability to claim a cause of action against them.

“Plaintiff alleges two common law causes of action (conversation and trespass to chattel), for which a three-year statute of limitations applies,” an attorney for the defendants argued in a filing on Aug. 6 (PDF). “Plaintiff further alleges a federal statutory cause of action, for which a two-year statute of limitations applies. Because plaintiff did not file his lawsuit until May 21, 2021, three years and five months after his injury, his claims should be dismissed.”

Schober’s attorneys argue (PDF) that “the statute of limitations begins to run when the Plaintiff knows or has reason to know of the existence and cause of the injury which is the base of his action,” and that inherent in this concept is the discovery rule, namely: That the statute of limitations does not begin to run until the plaintiff knows or has reason to know of both the existence and cause of his injury.

The plaintiffs point out that Schober’s investigators didn’t pinpoint one of the young men’s involvement until more than a year after they’d identified his co-conspirator, saying Schober notified the second boy’s parents in December 2019.

None of the parties to this lawsuit responded to requests for comment.

Image: Complaint, Schober v. Thompson, et. al.

Mark Rasch, a former prosecutor with the U.S. Justice Department, said the plaintiff is claiming the parents are liable because he gave them notice of a crime committed by their kids and they failed to respond.

“A lot of these crimes are being committed by juveniles, and we don’t have a good juvenile justice system that’s well designed to both civilly and criminally go after kids,” Rasch said.

Rasch said he’s currently an attorney in a number of lawsuits involving young men who’ve been accused of stealing and laundering millions of dollars of cryptocurrency — specifically crimes involving SIM swapping — where the fraudsters trick or bribe an employee at a mobile phone store into transferring control of a target’s phone number to a device they control.

In those cases, the plaintiffs have sought to extract compensation for their losses from the mobile phone companies — but so far those lawsuits have largely failed to yield results and are often pushed into arbitration.

Rasch said it makes sense that some victims of cryptocurrency theft are spending some serious coin to track down their assailants and sue them civilly. But he said the legwork needed to make that case is tremendous and costly, and there’s no guarantee those investments will pay off down the road.

“These crimes can be monumentally difficult and expensive to track down,” he said. “It’s designed to be difficult to do, but it’s also not designed to be impossible to do.”

As evidenced by this week’s CNBC story on a marked rise in reports of people having their Coinbase accounts emptied by fraudsters, many people investing in cryptocurrencies find out the hard way that unlike traditional banking transactions — funds lost to theft are likely to stay lost because the transactions are irreversible.

Traditionally, the major crypto exchanges have said they’re not responsible for lost or stolen funds. But perhaps in response to the CNBC story, Coinbase said it was introducing a new pilot “guarantee” for U.K. customers only, wherein they will be eligible for a reimbursement of up £150,000 if someone gains unauthorized access to their account and steals funds.

However, it seems unlikely Coinbase’s new guarantee would cover cases like Schober’s — even if he’d been a U.K. resident and the theft occurred today. One of the caveats that is not covered in the guarantee is sending funds to the wrong address by accident.