Payday Loan Network Sold Info to Scammers

vendredi 26 décembre 2014 à 15:09The Federal Trade Commission announced this week it is suing a consumer data broker that sold payday loan application data to scammers who used the information to pull money out of consumer bank accounts. The scam brings to mind an underground identity theft service I wrote about in 2012 that was gathering its data from a network of payday loan sites.

According to the FTC’s complaint, data broker LeapLab bought payday loan applications of financially strapped consumers, and then sold that information to marketers whom it knew had no legitimate need for it. “At least one of those marketers, Ideal Financial Solutions – a defendant in another FTC case – allegedly used the information to withdraw millions of dollars from consumers’ accounts without their authorization,” the FTC said.

The FTC charges that the defendants sold approximately five percent of these loan applications to online lenders, who paid them between $10 and $150 per lead. But the defendants also allegedly sold the remaining 95 percent for approximately $0.50 each to third parties who were not online lenders and had no legitimate need for this financial information.

In Sept. 2012, I published a blog post about “Usearching[dot]info,” a now-defunct ID theft service that offered the ability to purchase personal information on countless Americans, including SSN, mother’s maiden name, date of birth, email address, and physical address, as well as and driver license data for approximately 75 million citizens in Florida, Idaho, Iowa, Minnesota, Mississippi, Ohio, Texas and Wisconsin.

That story noted that Usearching[dot]info also included data that appeared to come from another source — more than 330,000 consumer bank account records pulled from an archipelago of satellite Web sites that negotiate with a variety of lenders to offer payday loans. From that piece:

“I first began to suspect the information was coming from loan sites when I had a look at the data fields available in each record. A trusted source opened and funded an account at Usearching.info, and purchased 80 of these records, at a total cost of about $20. Each includes the following data: A record number, date of record acquisition, status of application (rejected/appproved/pending), applicant’s name, email address, physical address, phone number, Social Security number, date of birth, bank name, account and routing number, employer name, and the length of time at the current job. These records are sold in bulk, with per-record prices ranging from 16 to 25 cents depending on volume.”

“But it wasn’t until I started calling the people listed in the records that a clearer picture began to emerge. I spoke with more than a dozen individuals whose data was being sold, and found that all had applied for payday loans on or around the date in their respective records. The trouble was, the records my source obtained were all dated October 2011, and almost nobody I spoke with could recall the name of the site they’d used to apply for the loan. All said, however, that they’d initially provided their information to one site, and then were redirected to a number of different payday loan options.”

I have no idea whether LeapLab sold information to this identity theft service, or whether Ideal Financial was a customer of Usearching[dot]info. LeapLab is no longer in business, and Ideal’s assets are frozen and in receivership. But it’s clear Ideal obtained consumer data from multiple sources: The FTC says LeapLab provided Ideal Financial with financial account information for only about 16 percent of Ideal Financial’s victims.

In this, as with so many financial scams, the people least able to afford it get scammed and fleeced. The FTC charges that Ideal Financial purchased information on at least 2.2 million consumers from data brokers and used it to make more than $43 million in unauthorized debits and charges for purported financial products that the consumers never purchased. Sadly, these “financial products” were mostly about how consumers could manage their money better or get themselves out of debt.

This scam is also a reminder of how crooks steal millions with small charges, all made through a vast network of phony company Web sites made to look like established companies with legitimate products. Also, these types of micropayment schemes are more common around the holidays, so now is good time for readers to keep an extra close eye on their bank and credit card statements for any unauthorized charges.

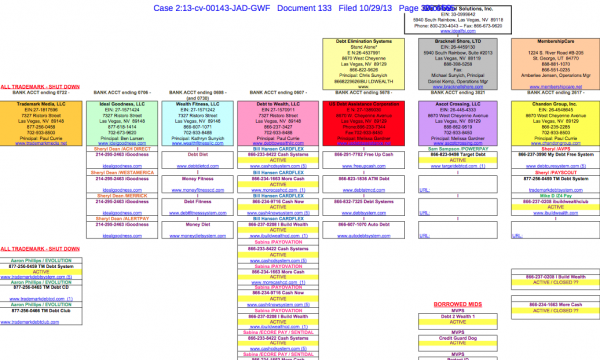

A network of shell companies the FTC says were set up to launder stolen funds for Ideal Financial Solutions.

A copy of the FTC civil complaint against LeapLab is here (PDF). Also interesting to read are these exhibits in the case (both PDF).